- Follow

- Business

- Posts

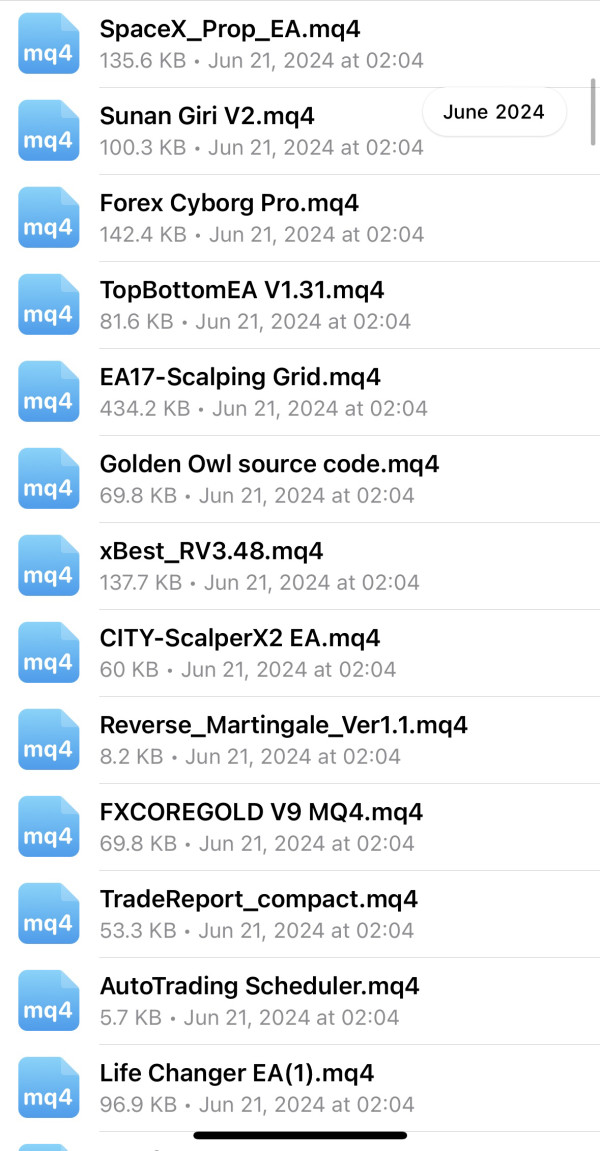

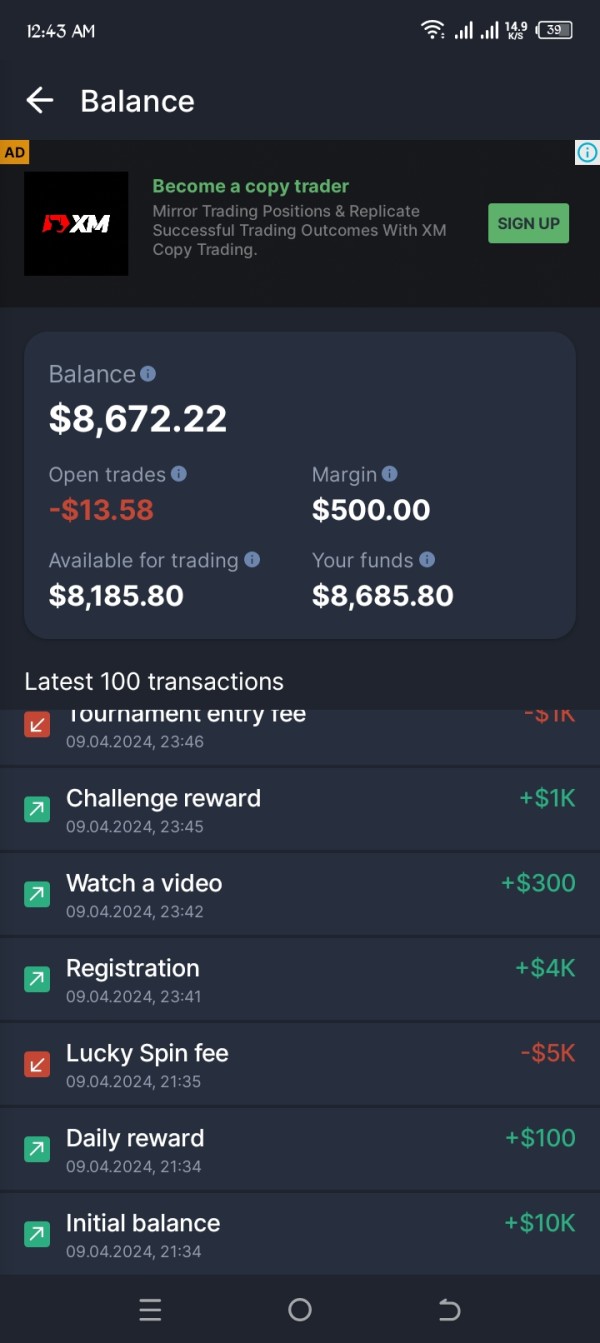

FreeExperAdvisor

Follow

We offer various types of free EAs (Expert Advisors) and indicators for MT4 and MT5 in gold and forex investments. Our solutions provide long-term, stable, and consistent profits. We welcome collaborations.

+Telegram:YF8001

Follow

Attentive service, five-star praise! mt4mt5 construction, foreign exchange broker website construc♞

Attentive service, five-star praise! mt4mt5 construction, foreign exchange broker website constructi #System#

.Telegram:@V1686

Follow

@Various financial platform software construction, including foreign exchange mt4/mt5, stock exchan*

Foreign exchange main label white label, exchange platform construction/dedicated deposit channel docking, license application, and those who can achieve stable long-term cooperation can be appropriately relaxed, click to view the link and join me to discuss in detail #System#

Various financial platform software construction, including foreign exchange mt4/mt5, stock exchange #System# #System#

Besta FX

Follow

The Besta Digital Currency Exchange was registered in Singapore in 2024 and is a global digital asset financial services platform. Its founding team consists of senior fintech professionals from New York and Singapore. The core developers all have backgrounds in top traditional stock exchanges and have independently developed a complete exchange and customer service system. Adopting the world's leading spot 3.0 system, it is more stable, safer and more transparent. Besta adheres to the principle of user first and constantly and repeatedly calculates the underlying technological architecture to improve user experience. We focus on the development strategy of spot + contract + wealth management and provide global users with digital asset financial services focusing on spot, contract, leverage, binary options, investment, and wealth management. Besta is an international digital asset financial service platform. Besta is committed to building a digital financial service platform with good customer experience, more new registered users, and a stable and secure technical architecture!

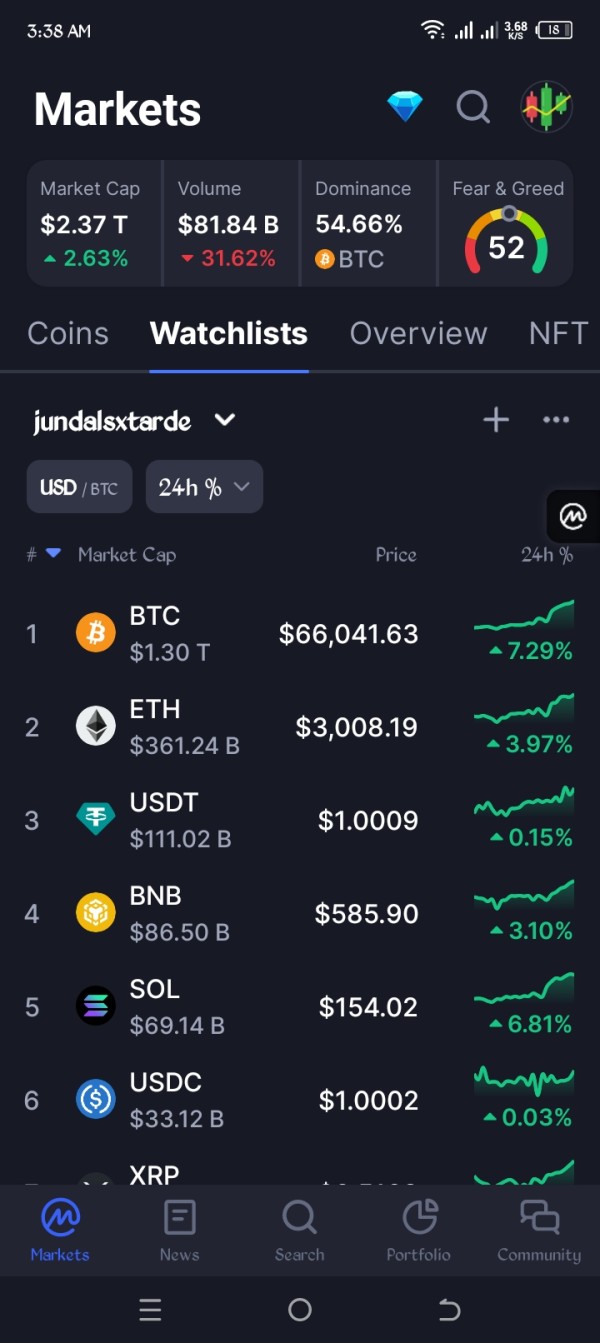

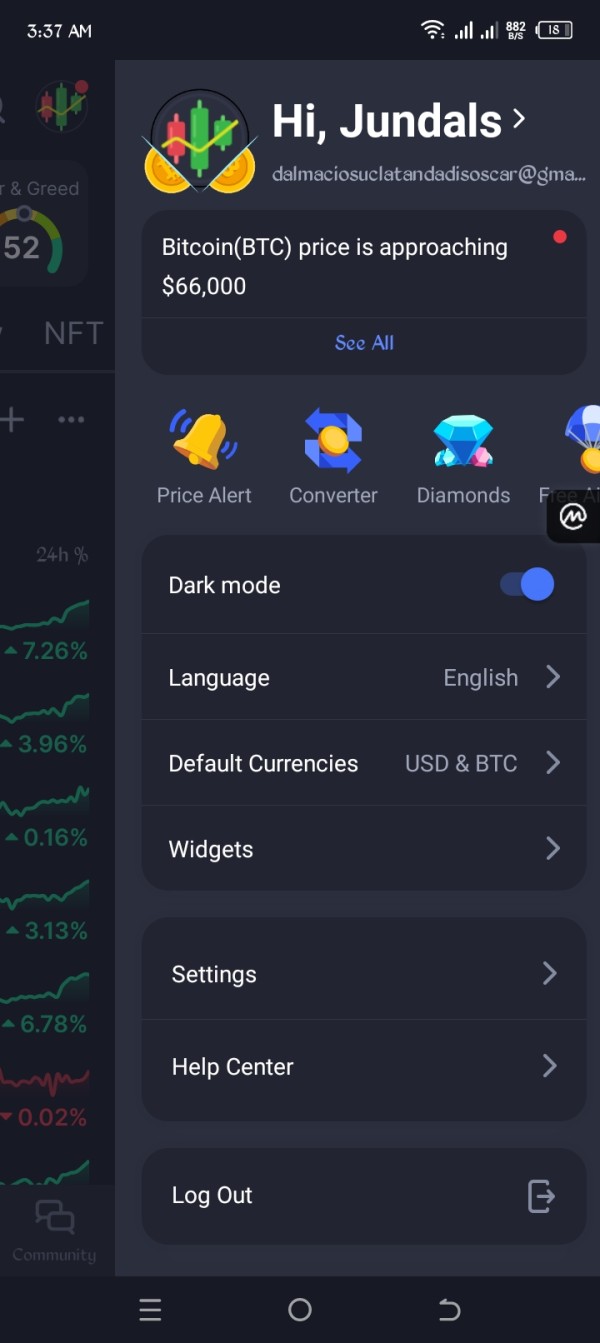

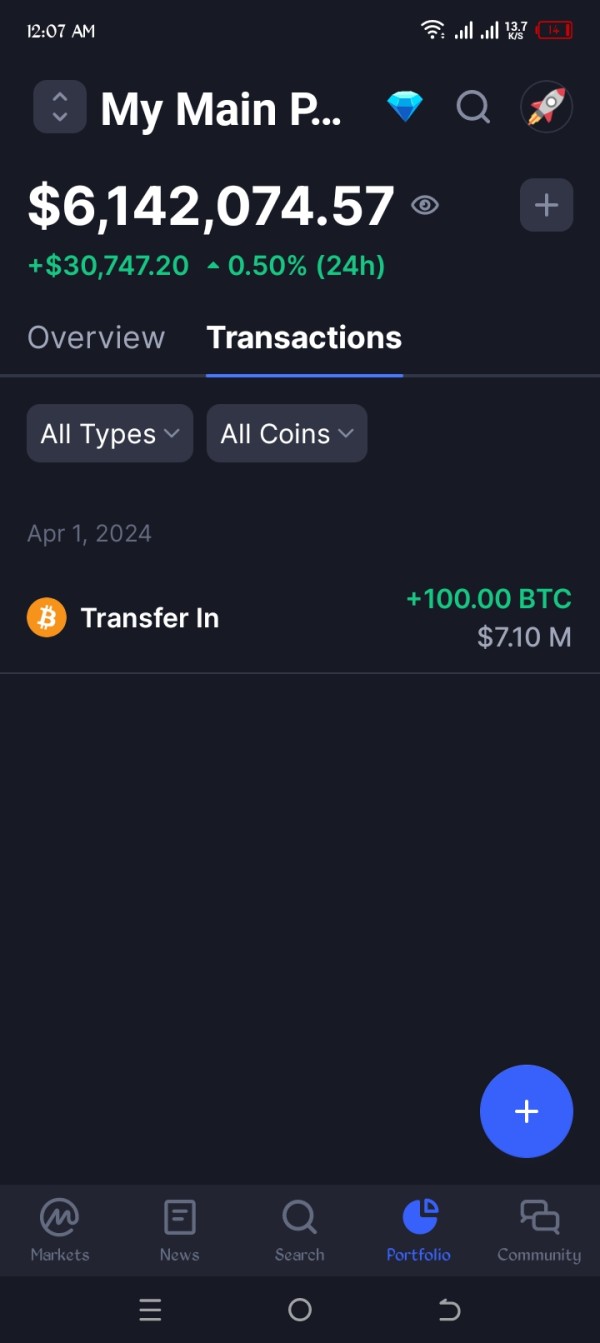

jundalsxtarde

Follow

drade

I hope I can earn some income here

GTCFX官方-dixon5333

GTC·Employee

Follow

GTC, UK FCA, Australian ASIC, UAE SCA, free Dubai visit, gifts, and activities!

Discover GTC Trading!

1. Regulated: UK FCA, Australian ASIC, UAE SCA

2. Fast Withdrawals: Within 15 minutes

3. High Leverage: Up to 500x, supports all strategies

4. Advanced Platforms: Genuine MT4/5, compensates slippage and delays

5. Social Trading: Free copy trading, MAM & PAMM supported

6. Flexible Trading: Minimum order 0.01, 20% margin call ratio

7. Premium Service: One-on-one manager, customized support

8. Convenient Deposits: Multiple channels

9. Exclusive Perks: Free Dubai visit, gifts, and activities

Join GTC for superior trading!

To get more details, please add my contact.

Uzair4331

Follow

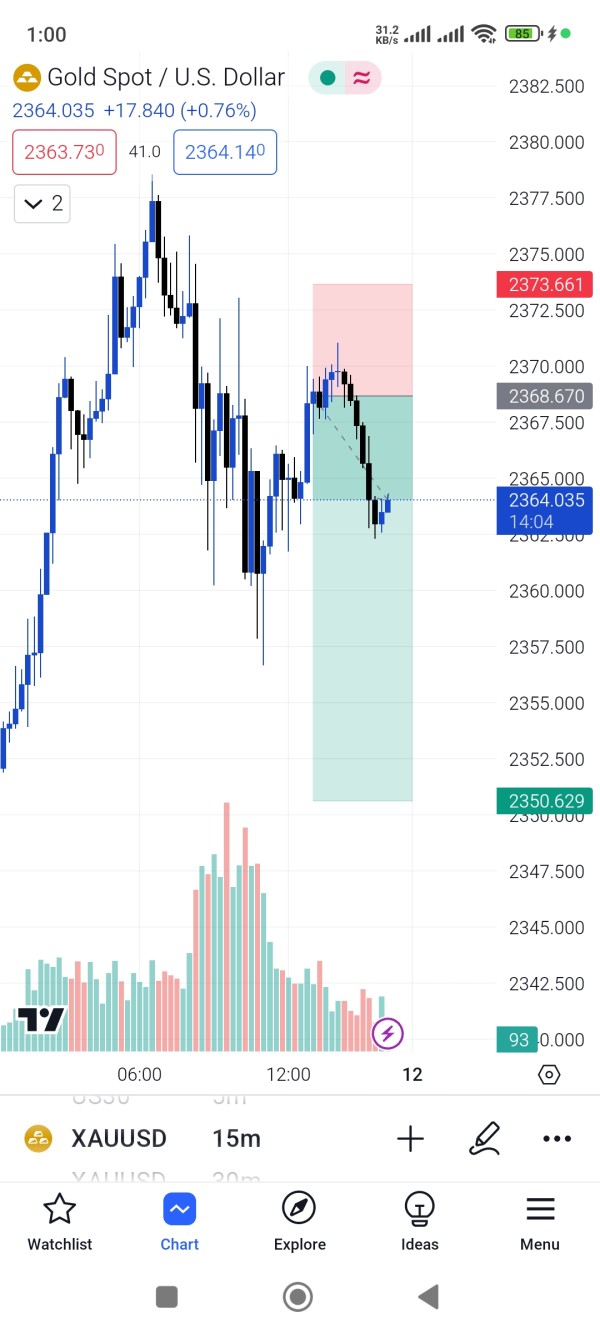

I will teach you advanced ICT concepts with my own modified model.

I am trading since 2018 and have strong grip on ICT and VSA with over 380 students worldwide. My modified models have over 80 percent win rate and maximum times it is 90 percent.

Mainly my models are for scalping gold.

加我飞机@tom312341或SK live:.cid.42d88687c1dcf88d

Follow

Bamboo Pay

VND, MYR, USDT, payment channel

The most stable in the market, automatic deposits arrive in seconds, and withdrawals are T0, fast and safety. Mainly engaged in forex broker, BC, welcome to discuss

欧创科技TG@Float99

Follow

white label solution、brokerage solution、white label setup!!

提供长期稳定技术7

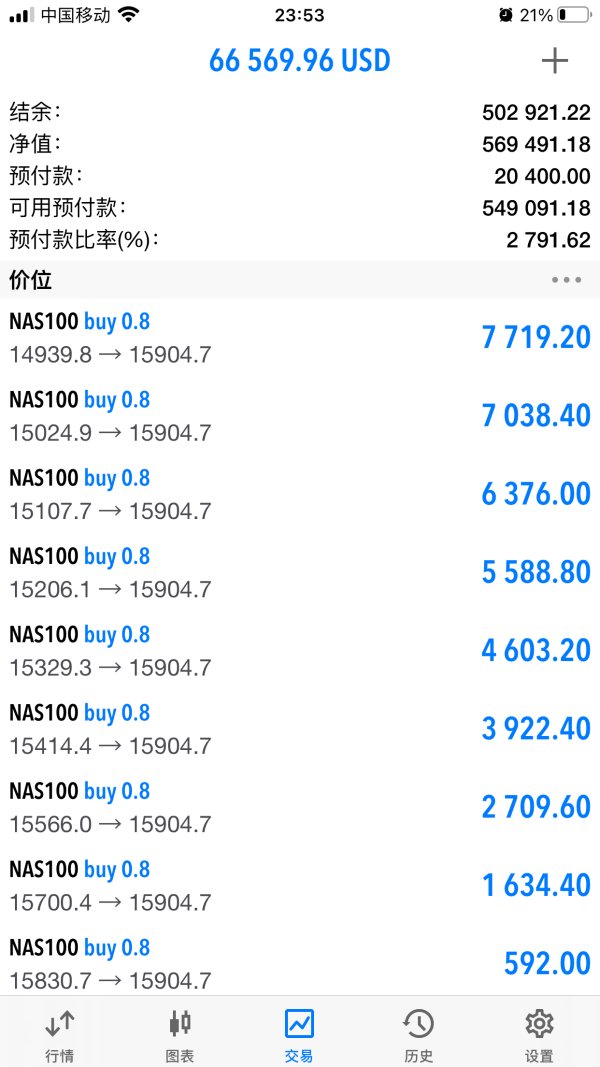

Follow

European and American quantitative EA trend tracking EA strength docking portfolio strategy trading model EA

Load More

Log in/ Register

Business

Posts

People you may like

Change

Lucreberg

Follow

Runninggirl

Follow

Housework

Follow

Gobi9751

Follow

Joju

FPG Fortune Prime Global·Employee

Follow