Score

IG

United Kingdom|Above 20 years| Benchmark AA|

United Kingdom|Above 20 years| Benchmark AA|https://www.ig.com/en

Website

Rating Index

Benchmark

Benchmark

AA

Average transaction speed (ms)

MT4/5

Full License

IG-LIVE2

Capital Ratio

Great

Capital

Influence

AAA

Influence index NO.1

Japan 8.76

Japan 8.76Benchmark

Speed:AA

Slippage:AA

Cost:C

Disconnected:AA

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomCapital Ratio

Capital Ratio

Great

Capital

Influence

Influence

AAA

Influence index NO.1

Japan 8.76

Japan 8.76Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 26 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United KingdomA Visit to IG in Australia – No Office Found

The survey team went to Australia to visit broker IG as scheduled, but didn’t find the company at its regulatory address. This denotes that the broker doesn’t have a physical business office at the place. Accordingly, investors are advised to make an informed decision following much deliberation.

Australia

AustraliaA Visit to IG in UK - Office Found

The investigators went to London, UK to visit the foreign exchange broker IG as scheduled, and spotted the broker’s name at its currently registered business address, indicating that the broker has a physical business office here. Unfortunately, the survey personnel were not able to enter the company for a special visit, so the specific scale of its business is unknown. Investors are advised to ma

United Kingdom

United KingdomA Visit to IG in Dubai UAE -- Office Found

The investigators went to Dubai, UAE to visit the foreign exchange dealer IG as planned, and found the dealer’s office at its foreign exchange regulatory address. The office location is real. Investors are advised to choose the dealer carefully.

United Arab Emirates

United Arab EmiratesA Visit to IG in Japan -- Office Confirmed Existed

The survey team went to visit the dealer IG in Tokyo, Japan as planned. The dealer’s logo can be found on the publicly displayed address, indicating that the dealer had a real business place. However, the surveyors failed to enter the company for further visit, so the specific scale of the business remained unknown. Please be prudent when trading with this broker.

Japan

JapanA Visit to the Singapore Broker IG

The visit by surveyors confirmed the authenticity of IG’s regulatory address. The surveyor was informed from a website that the broker held three full licenses issued by ASIC, FCA and FMA, as well as two retail forex licenses issued by FSA and MAS.Investors are advised to resort to their good judgement after consulting the said above.

Singapore

SingaporeA Visit to IG in Australia – No Office Found

The survey team went to Australia to visit broker IG as scheduled, but didn’t find the company at its regulatory address. This denotes that the broker doesn’t have a physical business office at the place. Accordingly, investors are advised to make an informed decision following much deliberation.

Australia

AustraliaA Visit to IG in UK - Office Found

The investigators went to London, UK to visit the foreign exchange broker IG as scheduled, and spotted the broker’s name at its currently registered business address, indicating that the broker has a physical business office here. Unfortunately, the survey personnel were not able to enter the company for a special visit, so the specific scale of its business is unknown. Investors are advised to ma

United Kingdom

United KingdomA Visit to IG in Dubai UAE -- Office Found

The investigators went to Dubai, UAE to visit the foreign exchange dealer IG as planned, and found the dealer’s office at its foreign exchange regulatory address. The office location is real. Investors are advised to choose the dealer carefully.

United Arab Emirates

United Arab EmiratesA Visit to IG in Japan -- Office Confirmed Existed

The survey team went to visit the dealer IG in Tokyo, Japan as planned. The dealer’s logo can be found on the publicly displayed address, indicating that the dealer had a real business place. However, the surveyors failed to enter the company for further visit, so the specific scale of the business remained unknown. Please be prudent when trading with this broker.

Japan

JapanA Visit to the Singapore Broker IG

The visit by surveyors confirmed the authenticity of IG’s regulatory address. The surveyor was informed from a website that the broker held three full licenses issued by ASIC, FCA and FMA, as well as two retail forex licenses issued by FSA and MAS.Investors are advised to resort to their good judgement after consulting the said above.

Singapore

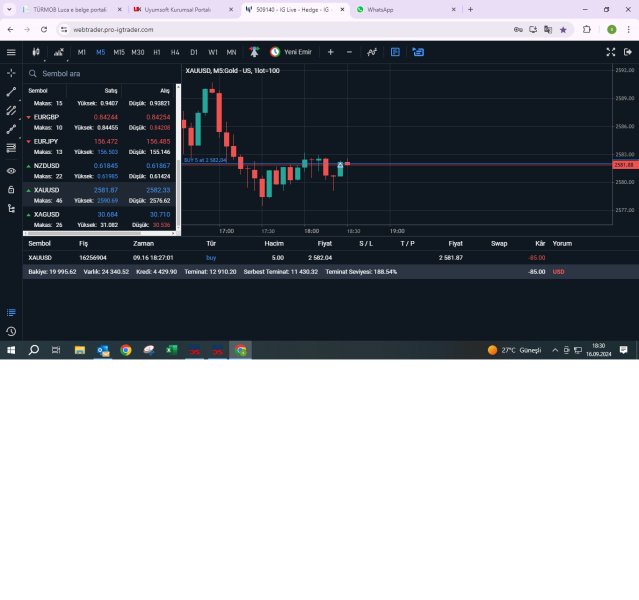

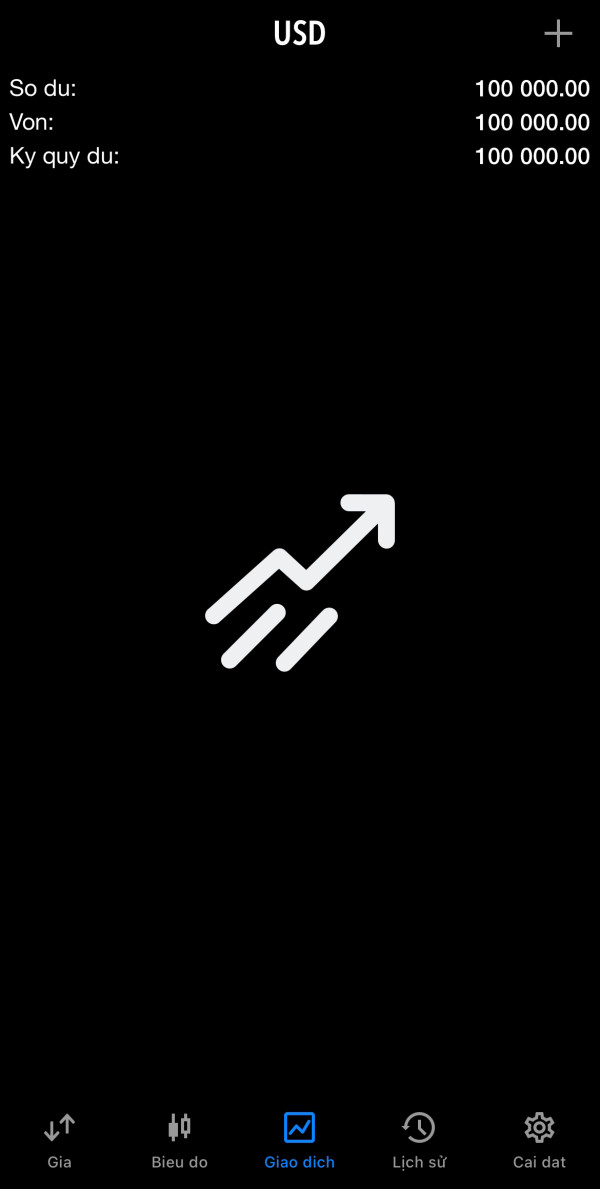

SingaporeAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed IG also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Benchmark

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Singapore

United Kingdom

South Africa

ig.com

Server Location

United Kingdom

Most visited countries/areas

United States

Website Domain Name

ig.com

Website

WHOIS.MARKMONITOR.COM

Company

MARKMONITOR INC.

Domain Effective Date

0001-01-01

Server IP

195.234.39.132

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

CLIFFORD JAMES ABRAHAMS

United Kingdom

Director

Start date

2024-12-16

Status

Employed

IG MARKETS LIMITED(United Kingdom)

ELLIOTT MICHAEL PERRY

Secretary

Start date

2024-11-13

Status

Employed

IG MARKETS SOUTH AFRICA LIMITED(United Kingdom)

MARIEKE FLAMENT

France

Director

Start date

2024-07-04

Status

Employed

IG GROUP HOLDINGS PLC(United Kingdom)

Company Summary

| Quick IG Review Summary | |

| Founded in | 1974 |

| Registered in | United Kingdom |

| Regulation | ASIC, FCA, FSA, FMA, MAS, DFSA |

| Market instruments | 17,000+, forex, indices, shares, commodities, cryptocurrencies |

| Demo Account | ✅($20,000 virtual funds) |

| Min Deposit | $0 |

| Leverage | Up to 1:400 |

| EUR/USD Spread | From 0.6 pips |

| Trading platform | L2 dealer, ProRealTime, MT4, TradingView |

| Copy Trading | ✅ |

| Payment Method | Credit/debit cards, bank transfer |

| Customer Service | 24 hours a day, except 6 am - 4pm on Saturday (UTC+8) - live chat |

| Regional Restrictions | USA |

General Information

IG is a UK-registered company and regulated by multiple international financial bodies, including the ASIC, FCA, FSA, FMA, MAS, and DFSA. It offers access to a 17,000+ markets, including forex, indices, shares, commodities, and cryptocurrencies. The company provides multiple trading platforms, including L2 dealer, ProRealTime, MT4, and TradingView.

What Type of Broker Is IG?

IG is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, IG acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of offering leverage.

However, this also means that IG has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interest of their clients. It is important for traders to be aware of this dynamic when trading with IG or any other MM broker.

Pros and Cons of IG

Pros:

- Wide variety of markets and instrument options

- Intuitive and customizable trading platforms

- Access to advanced technical analysis and charting tools

- Multilingual, multi-channel customer service

- Demo account with virtual financing of $20,000

- No minimum deposit requirement for real accounts

- Leverage up to 1:400

Cons:

- Fees and costs may not be clearly specified

- Withdrawal of funds is not clearly specified

- The minimum transaction amount is high for some markets

- Credit card deposit fees are high compared to other brokers

Is IG Legit?

Yes. IG is currently regulated by multiple regulatory authorities, including ASIC (Australia), FCA (UK), FSA (Japan), FMA (New Zealand), MAS (Singapore), and DFSA (UAE).

| Regulated Country | Regulator | Regulated Entity | License Type | License No. |

| Australia Securities & Investment Commission (ASIC) | IG AUSTRALIA PTY LTD | Market Making (MM) | 515106 |

| Financial Conduct Authority (FCA) | IG MARKETS LIMITED | Market Making (MM) | 195355 |

| Financial Services Agency (FSA) | IG証券株式会社 | Retail Forex License | 関東財務局長(金商)第255号 |

| Financial Markets Authority (FMA) | IG AUSTRALIA PTY LTD | Straight Through Processing (STP) | 684191 |

| Monetary Authority of Singapore (MAS) | IG ASIA PTE LTD | Retail Forex License | Unreleased |

| Dubai Financial Services Authority (DFSA) | United Arab Emirates | Retail Forex License | F001780 |

Market Instruments

IG offers access to 17,000+ markets, covering forex, indices, shares, commodities, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Shares | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Thematic and basket | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Spot | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

Account Type

IG offers a single live account withno minimum deposit required. Aside from live accounts, demo accounts are also available.

IG's demo account is a very useful tool for beginner traders, as it allows them to trade in a safe and risk-free environment. With IG's virtual funding of $20,000, traders can practice and hone their trading skills without risking their capital. In addition, the IG demo account provides access to the trading platform and all the instruments and tools available in the live account, allowing traders to familiarize themselves with the platform and test different trading strategies.

Leverage

As for the maximum leverage dimension at IG, the company offers a maximum leverage of up to 1:400. This means that traders can open positions that are 400 times larger than their available capital. Leverage can be a powerful tool for experienced traders, as it allows them to earn higher profits with limited capital. However, it can also significantly increase the risk of loss and it is important that traders fully understand the risks and limitations of leverage before using it.

Spread and Commission

In terms of costs, IG offers competitive, with EUR/USD spread starting from 0.6 pips. However, there is not much information available on commissions, which may create uncertainty for some traders. In addition, it is important to note that costs may be higher in less liquid markets or with lower trading volume.

Trading Platform

IG offers various trading platforms to meet the needs of different types of traders.

The web-based platform is intuitive and easy to use, although it may be less customizable than other platforms.

They also offer MetaTrader 4, a popular and well-known platform in the forex industry.

For experienced traders, L2 Dealer offers a wide range of advanced tools and functionalities. However, this platform can be more complicated for beginner traders.

Mobile apps are available for iOS and Android, allowing traders to trade on the go.

Deposit and Withdrawal

The minimum deposit for card payment is $50, and no minimum deposit required for Bank Transfer.

Deposit options including immediate credit/debit card transactions upon card registration, with up to five cards permissible per account.

For Hong Kong clients, cost-free FPS transfers in HKD are available and usually clear within one business day.

Bank transfers are also supported. Always include your account ID as a reference to ensure prompt and accurate allocation of funds.

However, fees of 1% are charged on Visa deposits and 0.5% on Mastercard deposits.

Unfortunately, there is no detailed information on withdrawal of funds, which may be a drawback for some customers.

IG Markets enables convenient funding through its mobile app, accessible under the 'add funds' section for both iPhone and Android users. Additionally, transfers can be made via Wise (formerly TransferWise), though users should check for any associated fees as IG Markets is not affiliated with Wise. For Wise transfers, proof of transaction and account details may be required.

Conclusion

In conclusion, IG is a well-established and regulated trading platform that offers a wide variety of financial instruments, an intuitive web platform and access to MetaTrader 4 and L2 Dealer. Although its demo account offers generous virtual funding, information on live accounts is limited. Multilingual customer service is available through multiple channels. However, there is very limited information on deposit and withdrawal.

Frequently Asked Questions (FAQs)

What is the minimum deposit required to open an account with IG?

No minimum deposit requirement.

What deposit methods are accepted on IG?

IG accepts deposits through credit/debit cards and bank transfers.

What is the maximum leverage offered by IG?

1:400.

What trading platforms does IG offer?

IG offers L2 dealer, ProRealTime, MT4, and TradingView.

Risk Warning

Trading online carries inherent risks, including the potential loss of invested capital. It may not be suitable for all traders or investors. It's essential to understand and acknowledge these risks before engaging in online trading.

Keywords

2024 SkyLine Thailand

- Above 20 years

- Regulated in Australia

- Regulated in United Kingdom

- Regulated in Japan

- Regulated in New Zealand

- Regulated in Singapore

- Regulated in United Arab Emirates

- Regulated in South Africa

- Regulated in Germany

- Market Maker (MM)

- Retail Forex License

- Straight Through Processing (STP)

- Financial Service Corporate

- Investment Advisory License

- Common Financial Service License

- MT4 Full License

- Global Business

- Suspicious Overrun

- High potential risk

News

News IG Group Acquires Freetrade for £160M to Expand UK Investment Market

IG Group acquires Freetrade for £160M, boosting its UK investment offerings. Freetrade to operate independently, with plans for growth and innovation.

2025-04-02 14:16

Exposure IG 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

2025-02-23 14:45

News IG Group to Shut Down IG Community by February 28, 2025

IG Group announces the closure of its IG Community on February 28, 2025, promising a future platform better suited for traders' needs.

2025-02-14 13:42

News Top Regulated Forex Brokers with Prop Trading Options

Know the top regulated Forex brokers offering prop trading options. Learn about challenges, psychology, and the best programs for trading success.

2025-02-03 17:35

News IG Japan Extends US Stock CFD Trading Hours in 2025

IG Securities Japan extends US stock CFD trading hours to 6:00 PM–10:00 AM starting January 2025. View the complete list of 30 stocks and important trading updates!

2025-01-21 15:17

News IG Group Enters Direct Investment Market with £160 Million Freetrade Buyout

IG Group, a prominent global financial trading and investment company, has announced its acquisition of Freetrade, a commission-free investment platform, for £160 million. The deal, funded through IG’s existing capital resources, marks a strategic move to expand its footprint in the United Kingdom.

2025-01-17 22:11

Comment 51

Content you want to comment

Please enter...

Comment 51

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX3418453235

Indonesia

I cannot withdraw funds. Rp 42,000,000 is forfeited. When I wanted to withdraw, there were many reasons given.

Exposure

02-15

FX2015418810

Turkey

I cannot withdraw my money and they are asking me to pay 375,000 TL again. I just want my money back. They are finding a lot of excuses. 🌲

Exposure

2024-09-19

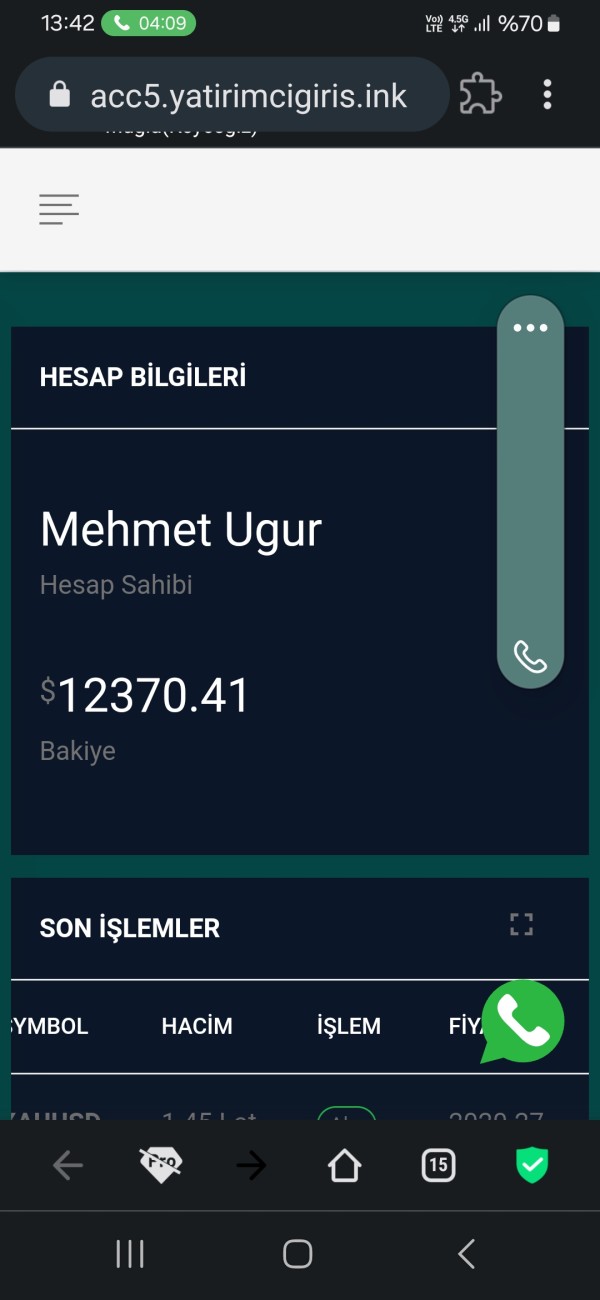

mehmet ugur

Turkey

I requested a withdrawal from this company about a month ago. I had to pay 4000 dollars for the bill I used. I paid it. They told me that I had to fund the bond again with 4,000 USD because you paid 2 pieces. I jumped up again and requested a withdrawal. This time they want an exchange rate difference of 100,000 TL. Is this legal? If so, this license is legal. What is it for? Please help.

Exposure

2024-03-22

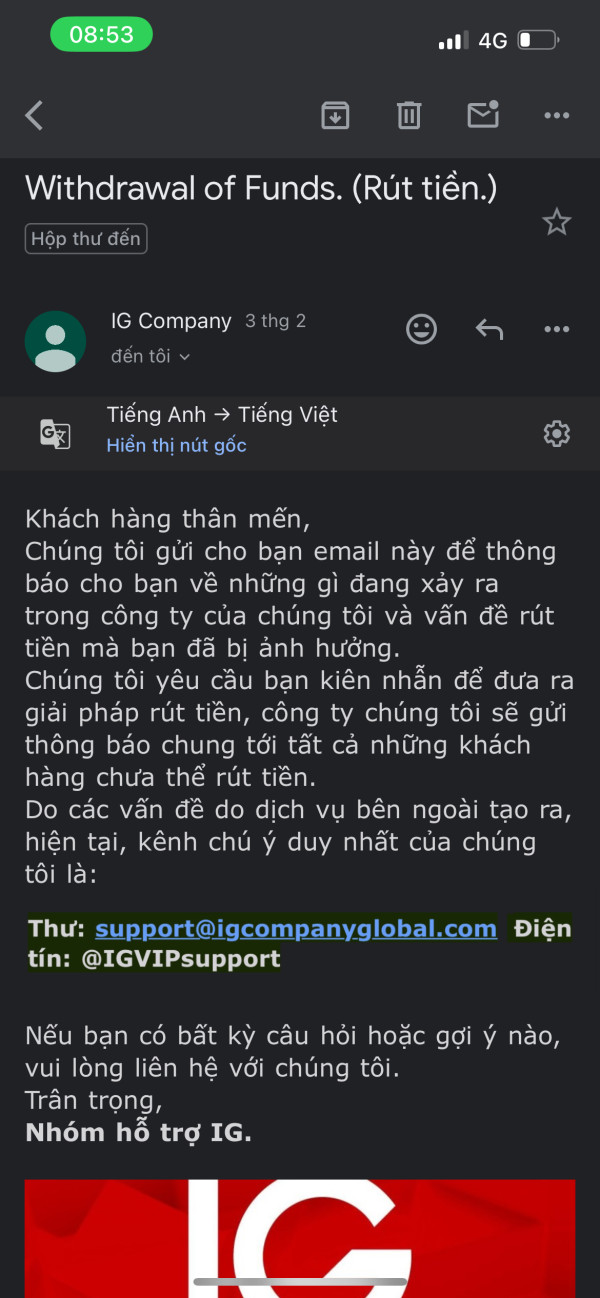

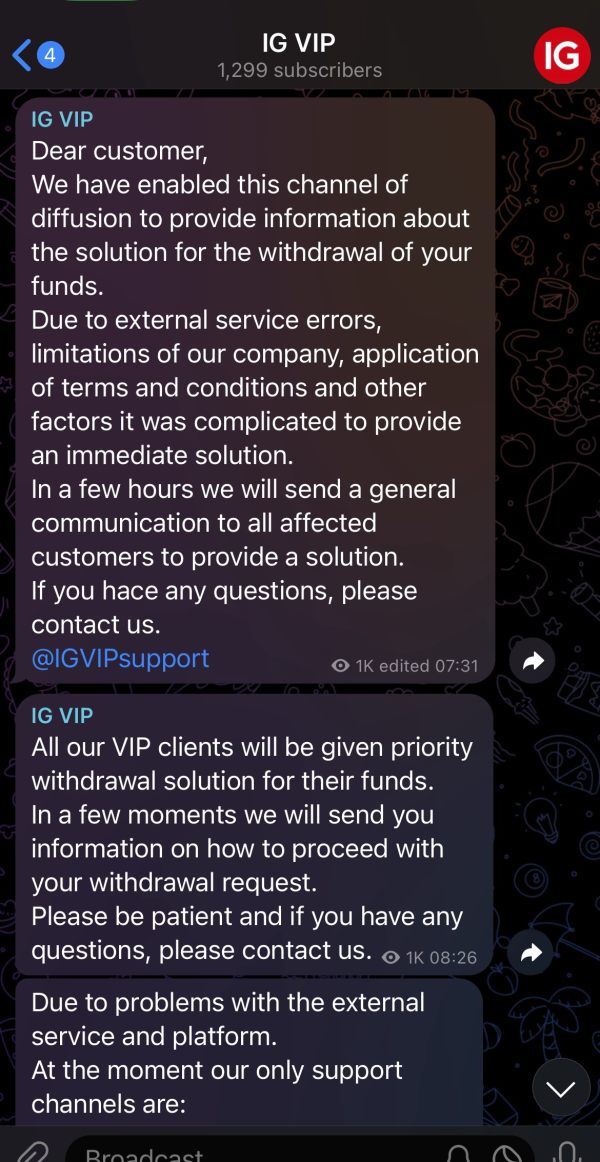

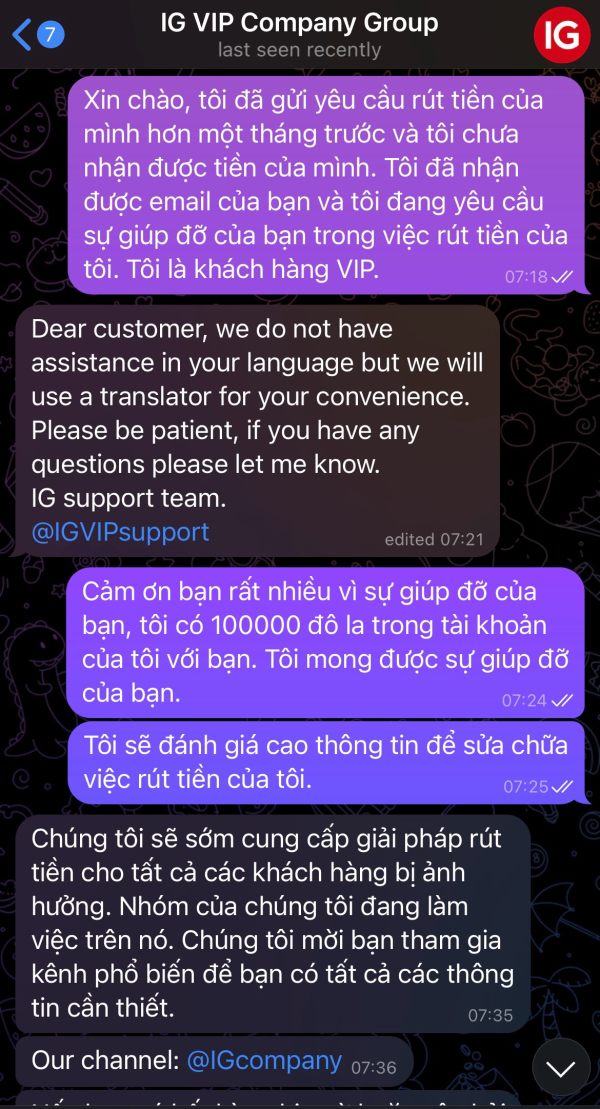

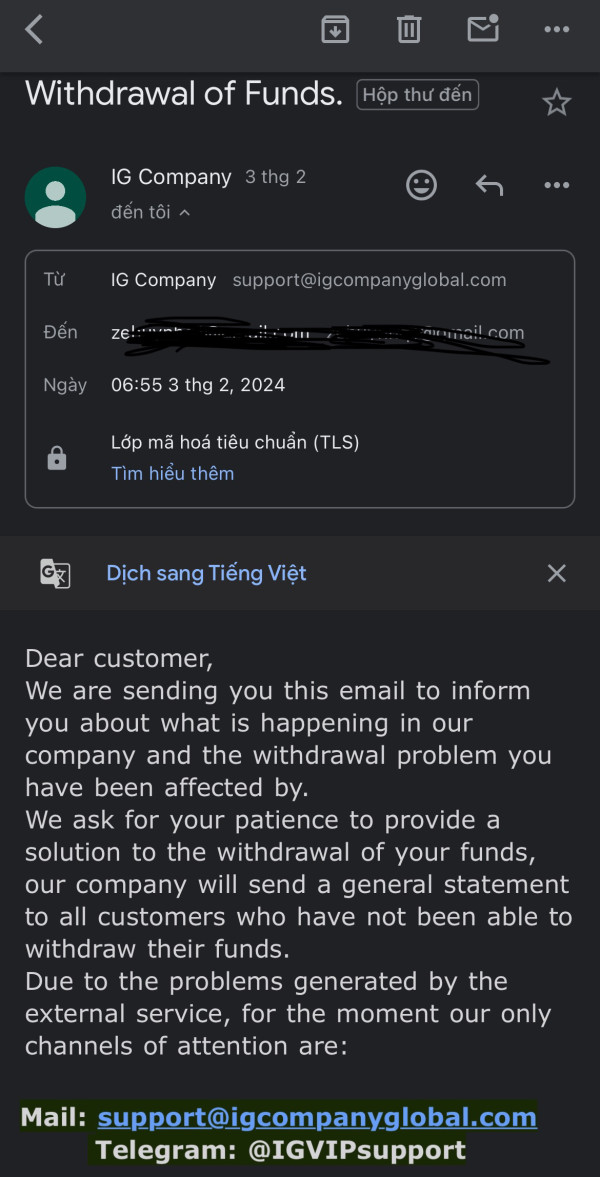

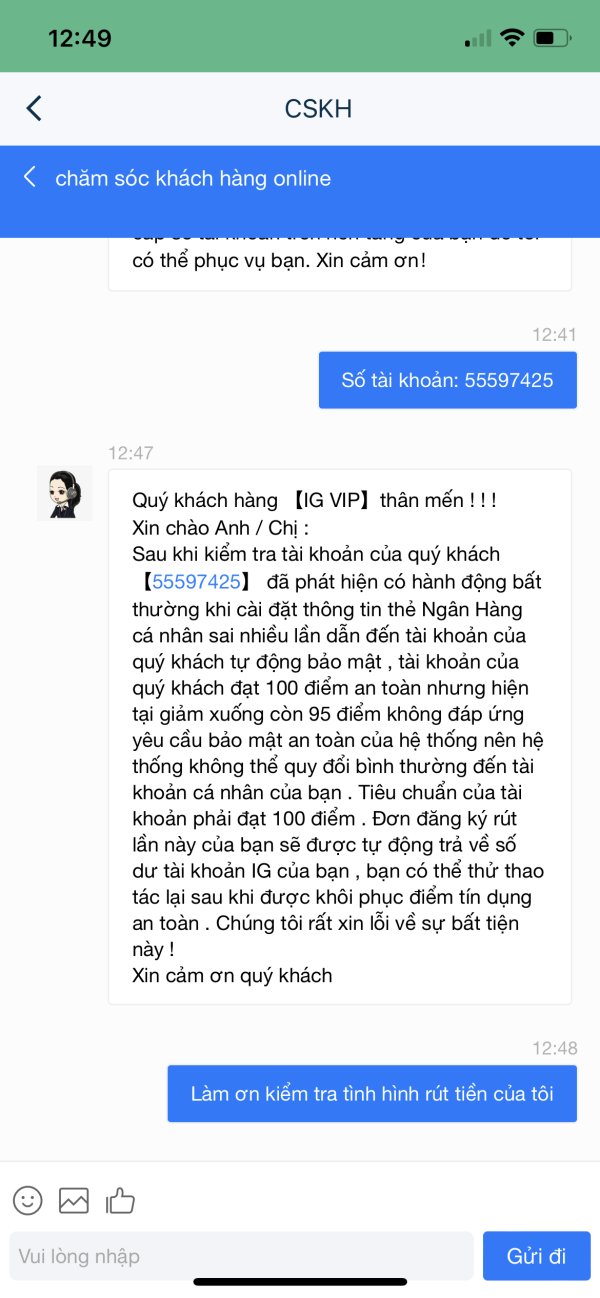

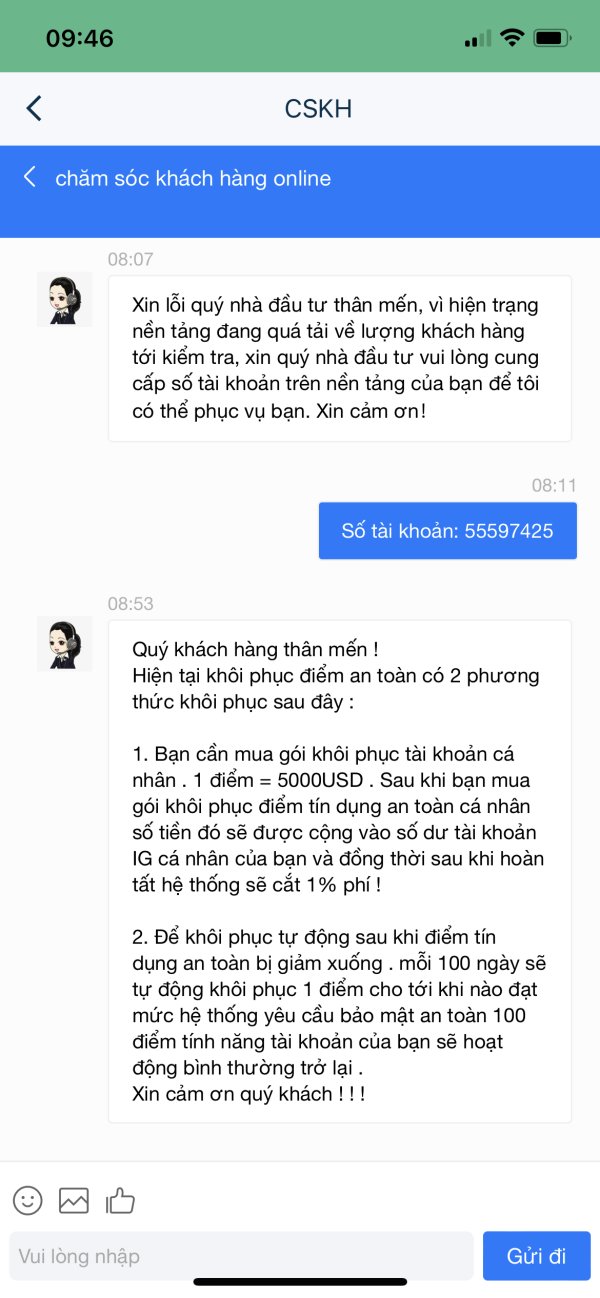

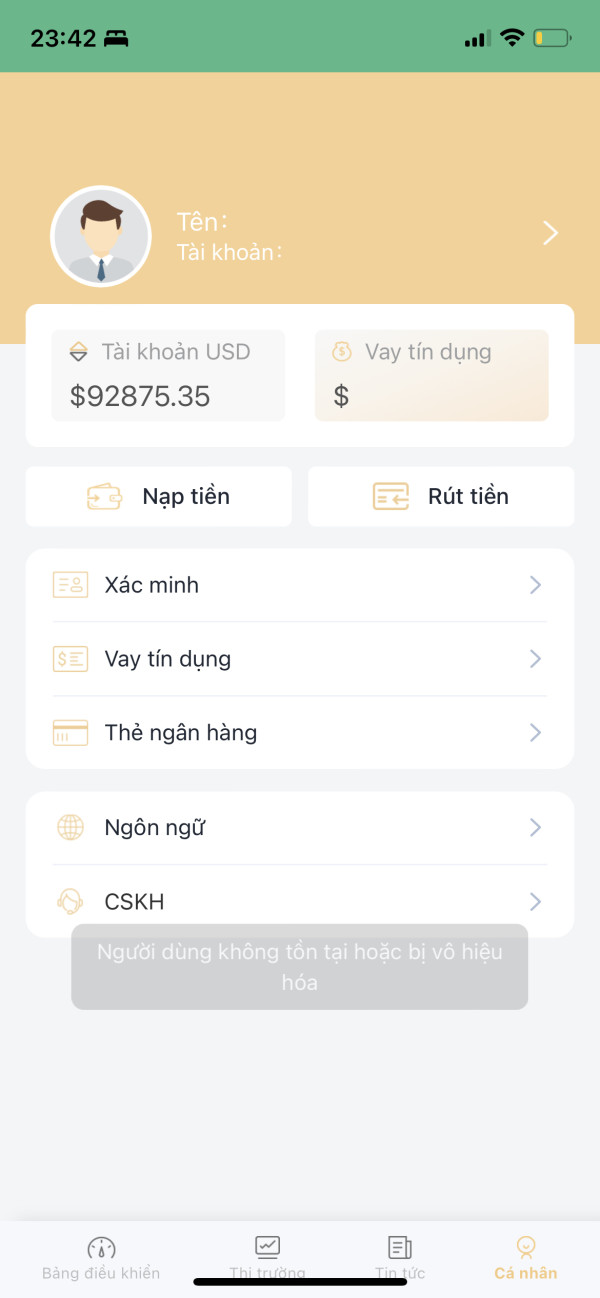

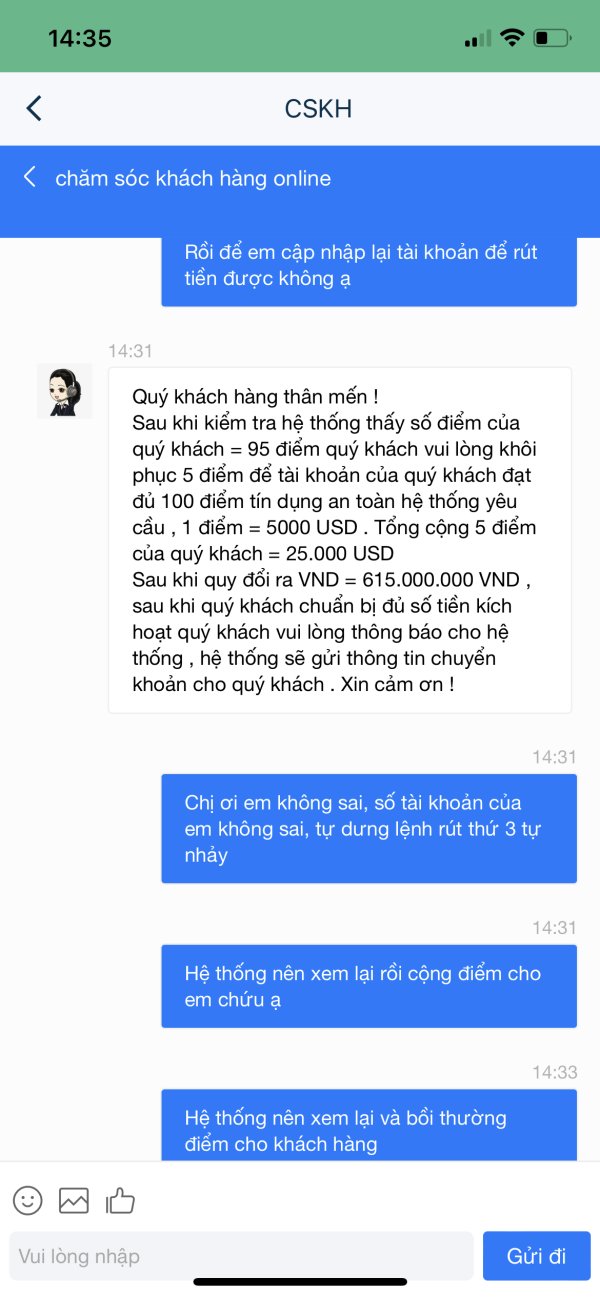

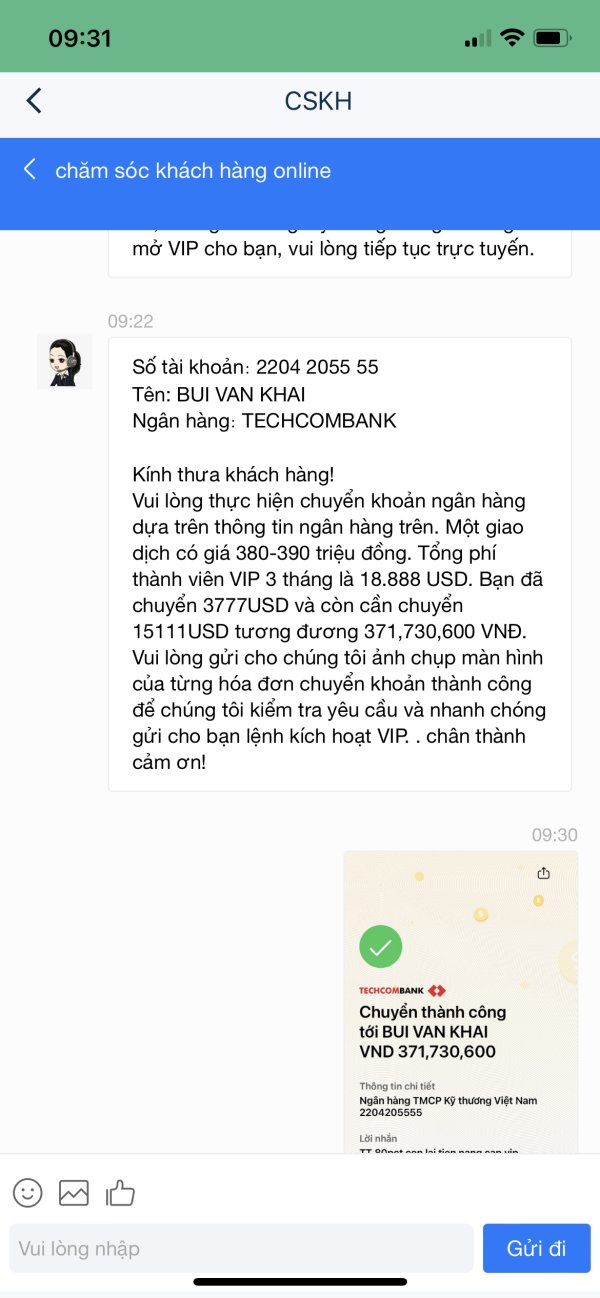

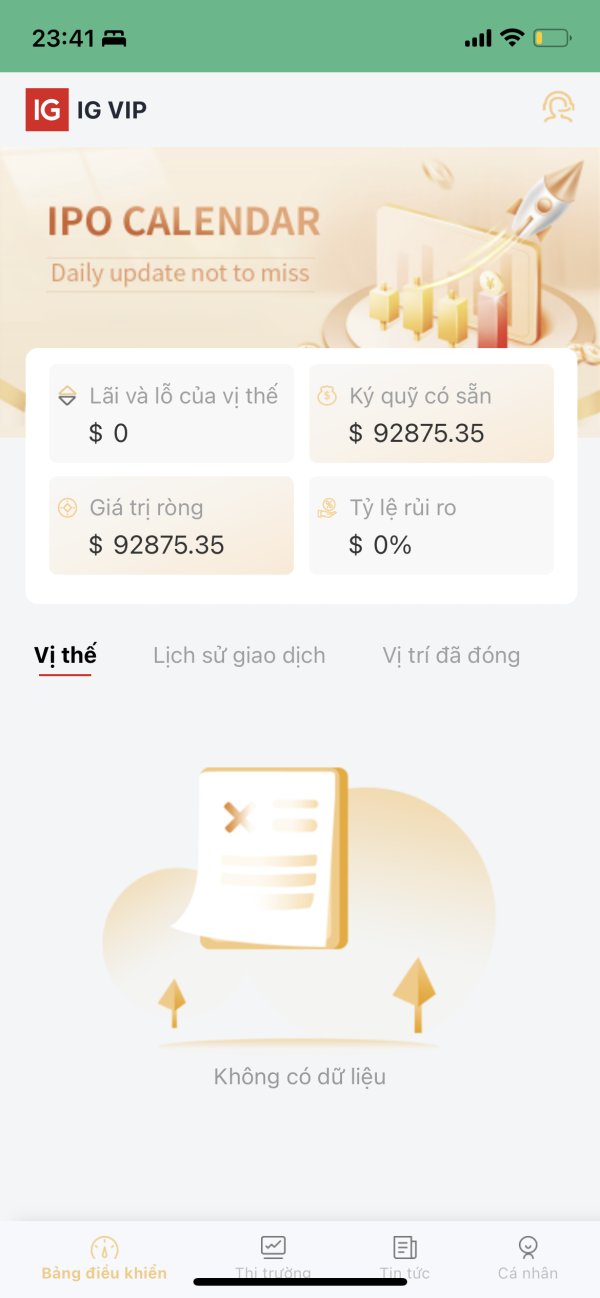

Huỳnh181

Vietnam

I requested a withdrawal from the IG VIP platform and I still haven't received it even though I'm a vip. After the complaint they sent me an email explaining that they would handle the withdrawal and that they had an issue on their platform, they asked me to wait as they would send a notification to all customers cannot withdraw their money. I'm just waiting for your IG VIP help so I can withdraw my money, please.

Exposure

2024-02-04

Ngocha

Vietnam

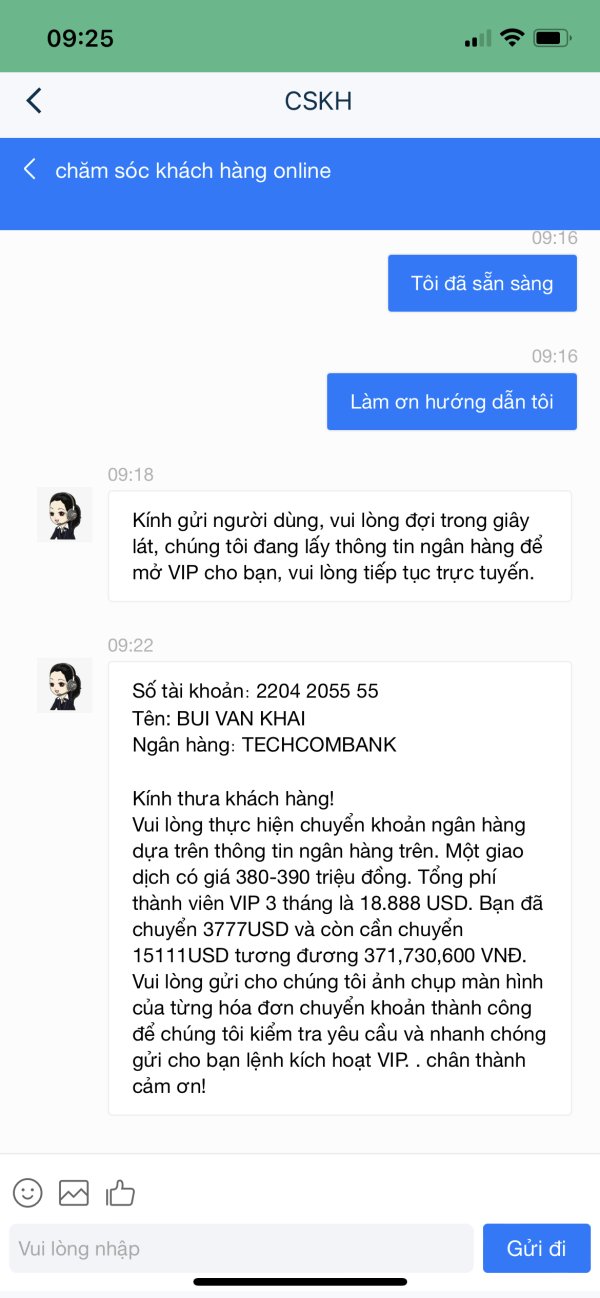

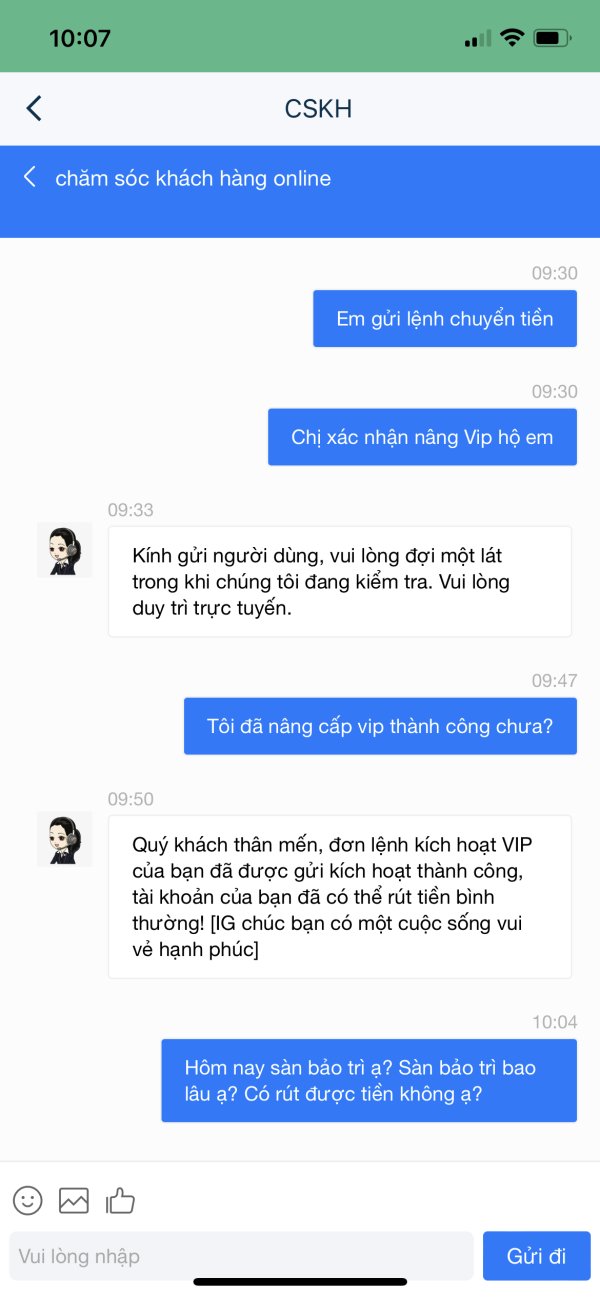

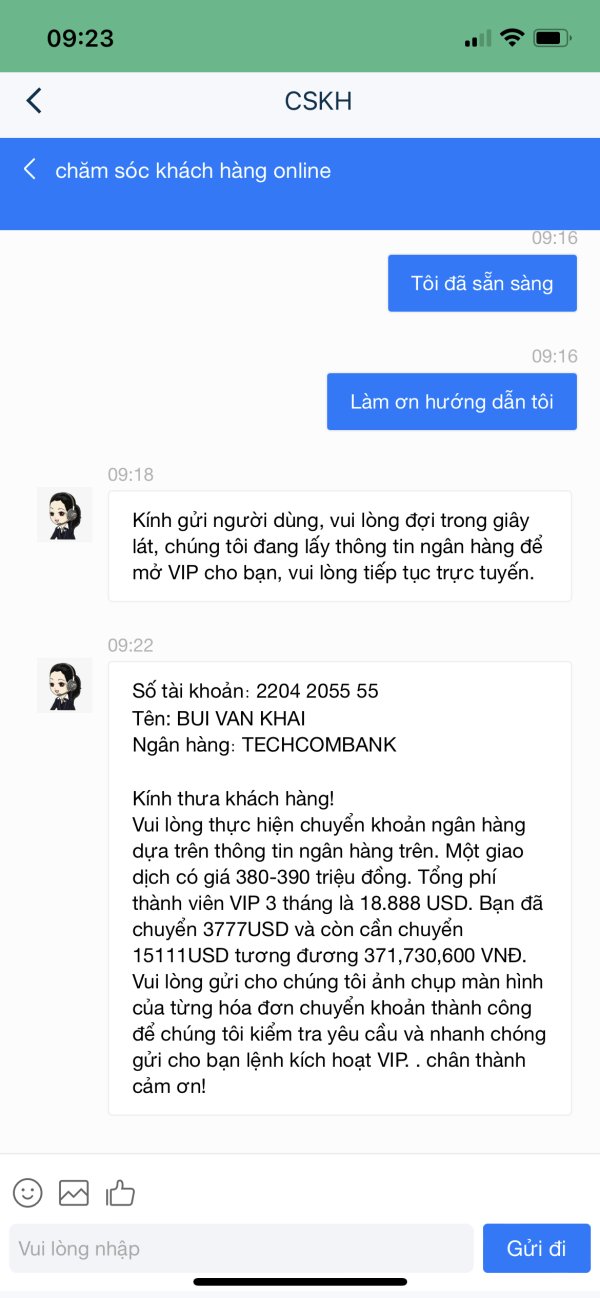

I have used the IG VIP app to invest since December 28, 2023. After withdrawing money 2 times, the app asked me to upgrade to VIP before I could withdraw again. I deposited money to upgrade VIP but still can't withdraw money. They deducted my points and forced me to deposit more to increase my withdrawal points. Currently it is January 29, 2024

Exposure

2024-01-30

HOÀNG THỊ THƯƠNG

Vietnam

I participated in trading on the IG platform from December 27, 2023 with account number 55565721 with a total deposit of about 12,000usd. Currently my account balance is 35k. I tried withdrawing a small amount of money on the IG 2 platform for the first time and it worked. When I made a profit, the third time I withdrew, the platform forced me to deposit money to upgrade to VIP before allowing me to withdraw. I found this extremely unreasonable. Why was my withdrawal limited by such unreasonable regulations? Now I don't have any money to deposit Vip because the deposit amount is too high, higher than the capital I deposited, so I can't deposit money to withdraw money, which means I will lose my entire account. Please assist me in withdrawing money. If I don't get it out I will die.

Exposure

2024-01-20

HOÀNG THỊ THƯƠNG

Vietnam

I participated in trading on the IG platform from December 27, 2023, account number 55565721 with a total deposit of about 12,000 USD. I tried withdrawing a small amount of money on the IG 2 platform for the first time and it worked. When I made a profit, I withdrew the third time and the platform forced me to deposit VIP money before allowing me to withdraw. I found this extremely unreasonable and cruel. Now I don't have any money to deposit VIP because the deposit amount is too high, higher than the capital I deposited, so I can't deposit money to withdraw money, which means I will lose my entire account. Please assist me in withdrawing money. I must get it out.

Exposure

2024-01-19

HOÀNG THỊ THƯƠNG

Vietnam

The first time I withdrew money from the IG platform, it was normal. The third time I withdrew, the platform forced me to deposit VIP money to withdraw. I found this extremely unreasonable. I don't have VIP deposit money, so I can't withdraw money, which means I will lose my account. Please assist me in withdrawing money.

Exposure

2024-01-18

12519

Hong Kong

After waiting for more than a month and no money being withdrawn, the website even threatened to sue me.

Exposure

2023-12-15

12519

Hong Kong

Every time the waiting time for withdrawing money has passed, the withdrawal is not allowed for various reasons.

Exposure

2023-12-14

12519

Hong Kong

After waiting for a month, I still cannot withdraw money, and I can no longer communicate with customer service.

Exposure

2023-12-14

鱼1453

Hong Kong

The withdrawal on September 4th has not arrived in the account, and the problem has not been resolved after contacting customer service for more than 36 hours.

Exposure

2023-09-06

BollinguerBand

Portugal

After opening an account there and submit all the necessary and required documents i received an email saying to be approved i must call IG. After many attempts, i was able to speak with a Spanish representative, and she mentions in order to be approved i need to contact the gentleman Pablo Castrillo. After another session of calls, i finally spoke with him and he mentions i need to send more documents in order to be approved. I confront him replying i have sent all the documents required by your website, to which he replied "my analyst needs more documents". I ask him for information about his analyst, he refused to disclose it. I sent several emails to support i never got an answer!! Finally, i got a rude answer from Pablo which i post here. Finally saying, IG has many factors to be a scam!

Exposure

2021-06-25

胡小卫

Hong Kong

In September this year, she (Mr. Football) joined me on WeChat through the Lanxi Chefs Exchange Group. I added her (Mr. Chef) as my friend on October 31st. She was cheated by a foreign exchange trading network platform. At first, I saw her. The foreign exchange sent by Moments is making money, and there is a mentality to try. The other party said that investing 20,000 to 50,000 is enough to earn 3 to 5 times the principal, and the profit is a 10% commission paid to their company, so I will invest 50,000. Therefore, through the introduction, she gave me a download platform, which can transfer funds to private accounts. I asked her customer service department that the charging channel is under maintenance. At around 3 pm on December 21st, use our designated chat tool. Hey, I bought pound and dollar fluctuations with other coaches. The time is the 60s. I did not follow up in the middle of the round and said I wanted to make up 74700. So I said I had no money, and the other party told me that she helped me. Can you borrow money? The next night, she said that she lent me 25,000 yuan and I personally collected 50,000 yuan. Starting from the evening of the 22nd of the second round of data calculation, I don't know why two wrong rounds were performed, but the data did not match, and I had to say it again. This time I didn’t have any money, nor did I have money to cover the position, so I went to withdraw the next day and found that the fund account was frozen. I contacted the customer service, and the customer service said that as long as there is money, if the payment has been made in full and not frozen, you can withdraw cash. . The other party contacted her and she said it was to help me find a solution. Their team borrowed another \25,000 and helped me recharge. I added 37,550 yuan myself. After turning in the frozen funds, I went to withdraw cash, but I still could not withdraw cash. The customer service department stated that this was due to credit score.

Exposure

2021-02-11

微微39646

Hong Kong

Freezing fund is needed if I wanna withdraw funds. Hope the problem can be solved asap

Exposure

2021-01-09

旧梦一场

Hong Kong

Looking at the regulated platform, as ordinary people, I believe in the IG platform. From the initial investment of 130,760 yuan to the completion of the operation, ask me to pay money cuz the bank card information is incorrect. At the beginning, I really thought that I had typed it wrong, so as a loyal customer, I chose to believe it unconditionally and paid the money again and again. Finally, the customer service told me that there was no problem, but I still waited 15 days for review. I would like to know if your platform is really not a lie. In the Internet age, what needs to be reviewed takes 15 days. To put it bluntly, it is a lie and no money is drawn. I also hope that the relevant department can help me recover the 1 million I handed in. Thank you.[d83d][de2d][d83d][de2d][d83d][de2d][d83d][de2d]

Exposure

2021-01-08

FX1932652030

Hong Kong

My fund has been frozen. The customer service said paying 30% can help me witdhraw 45,000. This is a trap

Exposure

2020-12-29

瑾三月

Hong Kong

At first I was told that the bank card number was wrong (I checked it twice before I fill it. And why can I hand in a wrong information? It’s the platform’s problem) and I have to pay margin so that the programmer can help me modify the number. Then I was noticed that my credit score was insufficient. What’s the relationship between my information error and credit score? Then, it turned to the tax. The customer service induced me to pay the tax twice. At last, the comprehensive score was reduced because of the payment. So the customer service asked me to deposit. What a rip-off

Exposure

2020-09-18

只想住你心李

Hong Kong

I have already called the police and I don’t know if I can get my principal back. I don't want to eat or drink and was deceived out of $60,000.

Exposure

2020-08-22

余生安好

Hong Kong

Both the withdrawal and service are unavailable! After paying the margin, rollover and handling fee, I was even asked to pay margin to Citigroup. Why I need to pay for it since I haven’t deposit fund through it. Is it legit? The withdrawal is yet to be received, albeit successful process.

Exposure

2020-06-21