What is DBG Markets?

DBG Markets, established in 2007, is indeed a well-known online broker, commanding a strong market presence for over a decade. It operates from its London and Sydney headquarters, while also maintaining offices across the Asia-Pacific and South America.

DBG Markets takes pride in offering a wide assortment of trading instruments, which include forex, precious metals, shares, indices, and commodities. It provides a maximum leverage of up to 1:500, giving traders the opportunity to maximise their trading capital.

Additionally, the broker's offerings are accessible via the MetaTrader 4 and MetaTrader 5 platforms - renowned platforms popular amongst traders for their advanced charting tools, automated trading abilities, and user-friendly interfaces.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

What Type of Broker is DBG Markets?

DBG Markets is a MarketMaking(MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, DBG Markets acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered.

However, this also means that DBG Markets has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with DBG Markets or any other MM broker.

Pros & Cons

Pros:

- Regulated by multiple reputable financial authorities, including FCA, ASIC, FSCA, and VFSC.

- Offers a wide range of trading instruments, including forex, precious metals, shares, indices, commodities.

- Offers risk-free demo accounts for traders to test.

- Offers the popular MT4 and MT5 trading platforms, as well as a range of educational resources.

- Provides multiple deposit and withdrawal options, with nofeescharged for deposits or withdrawals.

- Customer support is available 24/7 via live chat, online messaging, phone, and email.

Cons:

- DBG Markets does not offer services to residents of certain jurisdictions, including but not limited to the United States of America, Iran, Afghanistan, Belgium, Hongkong, Japan, or any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

- There is no clear information about the differences between the available account types or the minimum deposit required to open an account.

- The website does not provide information about commissions charged on trades.

Is DBG Markets Legit ?

DBG Markets is a regulated broker, operating under the oversight of several reputable financial regulatory bodies.

• DBG MARKETS (AUSTRALIA) PTY LTD is regulated by Australia Securities & Investment Commission (ASIC, No. 247017).

• DBG MARKETS (UK) LLP, its entity in the United Kingdom, is regulated by the Financial Conduct Authority (FCA, No. 469459).

• DBG MARKETS ZA (PTY) LTD, its entity in South Africa, has also registered with the Financial Sector Conduct Authority (FSCA) in South Africa, holding a Financial Service Corporate license under license no. 41920.

These regulators are known for their rigorous standards and require brokers to adhere to strict financial guidelines aimed at protecting traders.

However, while being regulated by these bodies grants legitimacy to DBG Markets, it's always recommended for traders to perform their due diligence when choosing a broker. This includes researching the broker's reputation, reading online customer reviews, and fully understanding the terms and conditions attached to the broker's services.

It's also important to note that while regulatory supervision can lower the risk of fraudulent activity, it can't eliminate such a risk entirely. Hence, adequate research and scrutiny should always be undertaken before deciding to trade with any broker.

Market Instruments

DBG Markets offers an extensive and diverse range of trading instruments with over 300 products available to traders.

This includes forex, ensuring access to the dynamic foreign exchange market with various currency pairs.

They also offer opportunities to trade in precious metals such as gold and silver, which can provide a hedge against economic instability.

For those who are interested in equity investments, DBG Markets offers trading on numerous shares from a variety of businesses.

Moreover, you can also access various indices, giving you the ability to take positions on the overall performance of a selection of companies in a specific market segment.

Additionally, they also offer commodities that could include energy products like oil and gas, agricultural goods, and more.

This wealth of options provides traders with many opportunities for portfolio diversification based on their own investment strategy and risk tolerance. Always remember to understand the risks associated with each instrument before investing.

Account Types

DBG Markets offers three account types tailored for different trading needs and preferences: Standard (STD), ECN, and VIP accounts.

The Standard Account provides a straightforward entry point for traders. It features spreads starting from 1.6 pips and offers trading instruments covering forex, precious metals, shares, indices, and commodities. This account type operates with zero commission and supports multiple currencies.

For traders seeking tighter spreads, the ECN Account is an excellent choice. It offers spreads from 0 pips, making it ideal for high-frequency traders and those employing scalping strategies. While it does come with a $6 commission, the potential for price improvement often outweighs this cost for many traders.

The VIP Account combines elements of both, offering spreads from 0.6 pips with zero commission. This account type is well-suited for experienced traders who maintain larger account balances and require premium trading conditions.

Notably, DBG Markets distinguishes itself by offering account opening with no minimum deposit requirement, providing accessible entry for traders at all levels.

How to Open an Account?

To open an account with DBG Markets, you would generally follow these steps:

Step 1: Visit the DBG Markets official website.

Step 2: Click on the “Open an Account” button located on the homepage.

Step 3: You'll be directed to an online registration form. Fill out the form with your personal information including your full name, email address, phone number, country of residence and choose the type of account you wish to open.

Step 4: Agree to the terms and conditions and click Submit.

Step 5: You may be required to verify your identity and address. This often involves uploading a clear, readable copy of your ID (like a passport or driver's license) and a proof of residence document (like a utility bill or bank statement that clearly shows your full name and address and is not more than 3 months old).

Step 6: Once your application is approved and your identity verified, you'll be able to fund your account.

Step 7: After making a deposit, you can then access your account and start trading.

You should check the exact details as per DBG Markets' policy on their website or by contacting their support service. It's also crucial to familiarize yourself with the trading platform, and understand all the risks involved in trading before you start.

Leverage

DBG Markets offers a maximum leverage of up to 1:500, which is relatively high compared to other brokers in the industry. This high leverage allows traders to open larger positions with a smaller deposit, potentially increasing their profit potential.

However, it also comes with significant risks as high leverage can amplify losses, especially for traders with limited experience or those who do not use proper risk management techniques. Traders should be aware of the risks associated with high leverage and use it responsibly to avoid excessive losses.

Spreads & Commissions

DBG Markets offers a tiered structure of spreads and commissions across its three account types. The Standard (STD) Account features spreads starting from 1.6 pips with no additional commission, suitable for traders who prefer straightforward pricing. For those seeking tighter spreads, the ECN Account provides spreads from 0 pips, coupled with a $6 commission per trade, appealing to high-volume and algorithmic traders. The VIP Account strikes a balance, offering spreads from 0.6 pips without commission, tailored for experienced traders with larger account balances.

Overall, DBG Markets appears to offer pricing that's in line with industry standards, with potentially advantageous terms for higher-volume traders.

Trading Platforms

DBG Markets offers access to four chocies of trading platforms for clients who trade on this platform: MetaTrader 4 & MetaTrader 5, PAMM/MAM, as well as a webtrader.

MetaTrader 4 (MT4)

DBG Markets provides the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both renowned for their robust features and user-friendly interfaces. These platforms are accessible across multiple devices, including desktop computers, mobile phones, and tablets, as well as through web browsers, ensuring traders can manage their positions from anywhere.

MetaTrader 5 (MT5)

PAMM/MAM

For investors seeking managed accounts, DBG Markets supports PAMM/MAM systems, allowing for efficient fund management.

WebTrader

Additionally, the broker offers a proprietary Webtrader platform, providing a lightweight, browser-based alternative for traders who prefer not to download software.

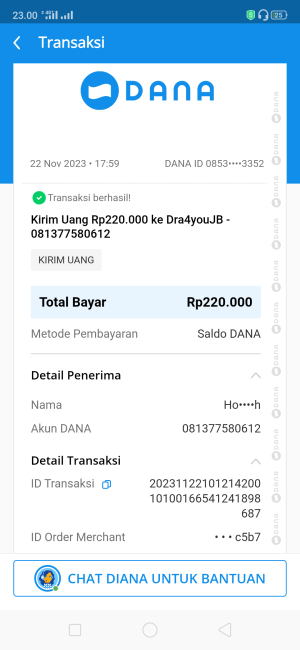

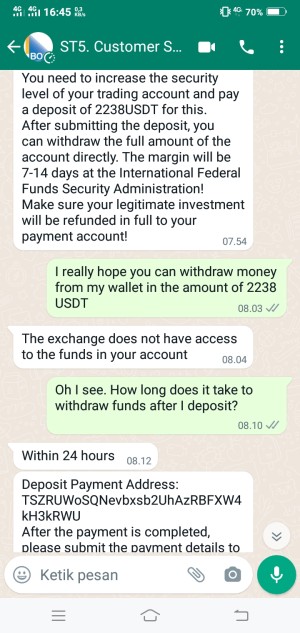

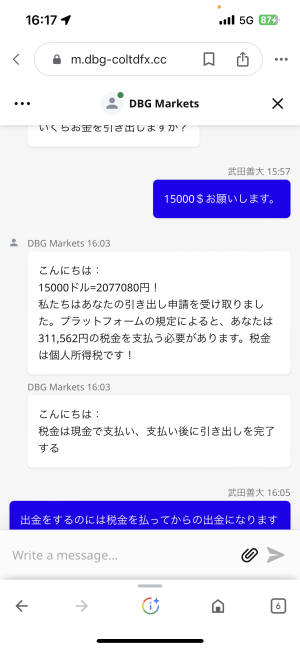

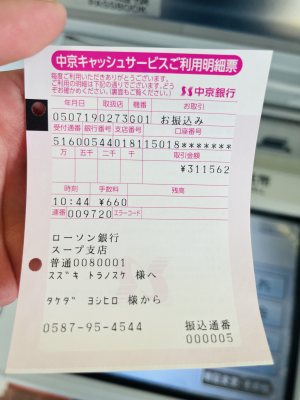

Deposit & Withdrawal

DBG Markets offers a variety of deposit and withdrawal options, including Visa, Bank Transfer, Chinese UnionPay, Skrill, Webmoney, and Crypto, with no fees for transactions. The company supports various currencies such as USD, EUR, GBP, AUD, NZD, CAD, CNY and USDT.

However, there is limited information about the minimum deposit and maximum withdrawal amount.

Most of DBG Markets' deposit and withdrawal methods are geared for instant transactions, providing a smooth flow of funds for DBG Markets' clients. However, it's worth noting that transactions involving Bank Transfers may take a bit longer. Deposits done via Bank Transfer could take approximately 1-3 working days to arrive and be processed, while for withdrawals a processing time of 1 working day is usually required. This expected delay is generally due to the banking systems and processing times of the banks involved, which vary between institutions. Thus, it is advisable to plan your transactions ahead, particularly if you prefer using Bank Transfers for your financial operations.

Customer Service

DBG Markets offers multiple channels for clients to reach out with inquiries or concerns. The brokerage maintains a support team accessible via phone at +27 0861888221 and email atsupport@dbgmfx.com. For those who prefer written communication, a message form is available on their website, allowing clients to submit detailed inquiries. Online chat is also available, which supports English, Vietnamese, and Chinese communication.

Physical Address: No. 9 Cassius Webster Building, Grace, Complex, PO Box 1330, The Valley, AI-2640 Anguilla

However, there is limitedFAQ section available on their website, which can be inconvenient for traders seeking quick answers to common questions.

However, there is no dedicated account manager available, and DBG Markets does not provide support through social media platforms.

Frequently Asked Questions (FAQs)

Is DBG Markets regulated well?

Yes. It is regulated by ASIC in Australia, FCA in the UK, and FSCA in South Africa.

At DBG Markets, are there any regional restrictions for traders?

Yes. It does not offer services to residents of certain jurisdictions, including but not limited to the United States of America, Iran, Afghanistan, Belgium, Hongkong, Japan, or any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Does DBG Markets offer demo accounts?

Yes, it offers demo accounts.

Does DBG Markets offer industry leading MT4 & MT5?

Yes. Both MT4 and MT5 are available.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX